Pinbar pattern scanner utilizes Pinbar and its application with outside and inside bar to alert the trader of possible Price rejection in any forex symbol in any of the 9 timeframes, all from the simplicity of one open chart.

Yes! ..You heard me right. All 9 timeframes of all pairs you provide in the Symbols input.

Patterns in the scanner are:

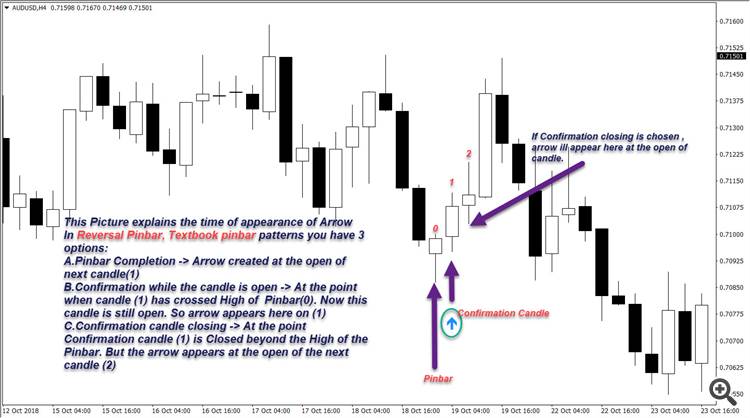

1. Reversal Pinbar

3 candles pattern followed by a confirmation candle. (Two opposite color candle followed by pinbar, then by Confirmation candle)

2. Dual Pinbar

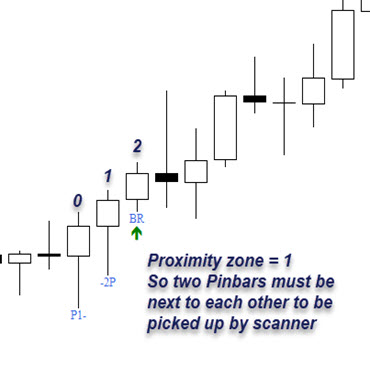

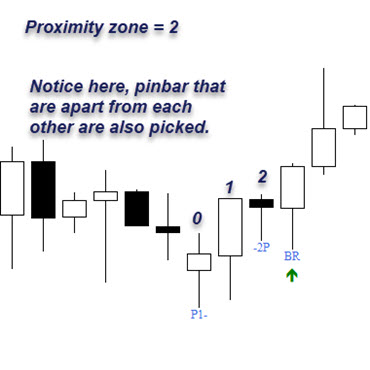

Dual pinbar is just as the name implies, Two pinbar occurring close one another with certain properties. The trader has the option to restrict how close to each other the two pinbars in Dual pinbar have to be for the pattern to be valid. Same applies to pinbar outside bar pattern.

3. Textbook Pinbar

Back to basics, The Textbook pinbar is a one candle pattern.

How to trade Pinbar Reversal

As much as I would like to say that the apple fell on my head, I discovered gravity and not Newton, i can't. Likewise, Pinbar trading has been done by thousands of traders, if not more and it has stood the test of time and has been proven Profitable. So I will point out the Gist of the strategy, I have studied during my training.

Most important Point - It takes much more than a single candlestick to reverse a trend. You need to stop seeing pinbar as a pattern and start to understand what it stands for - Price rejection by the market.

To answer the question “Do all Pinbars reverse a Major trend?” the answer would be obvious to anyone who has been trading for a while -----a big NO

So how do we select the ones that do have significance::

1. Trading with the trend.

2. Trading from an area of value.

3. Trade Pinbars with 1.5 times the average true range (ATR)

Trading with the trend

Trading from an area of significance

This is where the understanding of support-resistance or Supply-Demand comes to your aid. Please see the following pic.

If it’s an uptrend, then wait for the price to come to your area of value (Supply and demand zone). When the price comes to an area of value, then go long when you see a bullish Pinbar (or price rejection). If you’re long, then place a stop loss below the low of Pinbar (preferable D1 timeframe). If the price goes in your favor, then take profits at the nearest swing high.

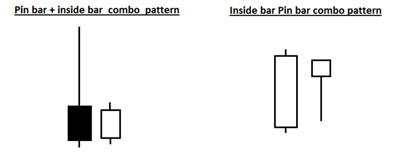

4. Inside & Pinbar combo

This combo has two powerful patterns – Pinbar which shows price rejection and Inside bar which shows consolidation and tells potential breakout is imminent. This is my favorite among the patterns to enter trades when they occur at key support and resistance areas.

How to trade Inside Pinbar

Look for inside-pinbar combo patterns in strong trending markets, they are very reliable as breakout/ trend – continuation plays. Inside pinbar setups are best on the daily timeframe whereas Pinbar-inside bar combo works well on both the daily and 4-hour chart timeframes.

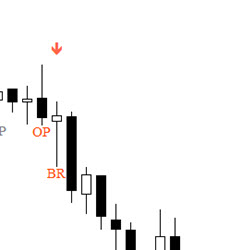

5. Outside & Pinbar combo

Pinbar outside bar two elements - Pinbar and Outside separated by the proximity number. Outside Pinbar is just one candle which is a pinbar with HI/LO outside the HI/LO of previous bar.

Pinbar Outside bar combo are used to identify buying or selling pressure in a trend and can be used to identify impulse moves from an Overbought or Oversold area. On that note, the scanner also comes with RSI filter to accommodate this feature.

How to trade Pinbar Outside bar

Inputs in the scanner:

- Symbols to check: EURUSD,AUDUSD,CHFJPY,CADJPY

- M1 Timeframe On? (Y/N):

Note - Only on enabling the timeframes do the alert function Work. Alert on disabled timeframes will not pop up.

- M5 Timeframe On? (Y/N):

- M15 Timeframe On? (Y/N):

- M30 Timeframe On? (Y/N):

- H1 Timeframe On? (Y/N): Yes

- H4 Timeframe On? (Y/N): Yes

- Daily Timeframe On? (Y/N): Yes

- Weekly Timeframe On? (Y/N):

- Monthly Timeframe On? (Y/N):

GENERAL PATTERN OPTIONS------- Rules apply to pinbar in Reversal pinbar, 2nd pinbar in Dual Pinbar, Outside Pinbar

- Candle ATR multiplier: To rule out the ones in Low volatility area.

- ATR period: 14

- Strict Pins On? (Y/N): Enables the following two options.

- Body Max Percentage%: Percentage of pinbar body/candle ratio

- Body Located Percentage %: If value = 40, scanner only detects Bullish Pinbar with the body in the upper 40% of the candle and for Bearish, body in the Lower 40%.

- Short Wicks On? (Y/N): Enables the following option.

- Short Wick Percentage %: If value = 10, Nose of the pinbar must less than 10 percent of the whole candle to be valid.

- Max Bars: 200, Looks at last 200 candles of the chart for patterns. Since the scanner is going to working in many chart and timeframes, Please refrain from using High numbers.

REVERSAL PINBAR PATTERN OPTIONS-------

- Reversal PinBar On? (Y/N): Individual patterns can be turned On or off. Only Yes option will show them on the chart and raise alert from other Tfs.

- PinBar Pattern Type: 3 Choices - draws an arrow on a.Pinbar completion, b.Confirmation while the candle is open and crossed High or Low of Pinbar, c.Confirmation candle closing beyond Hi/Lo

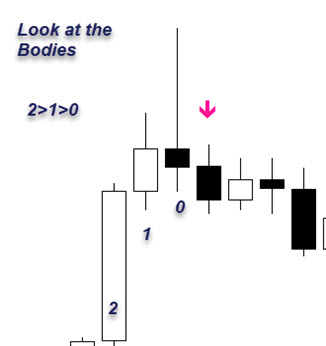

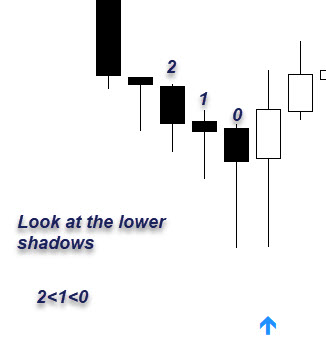

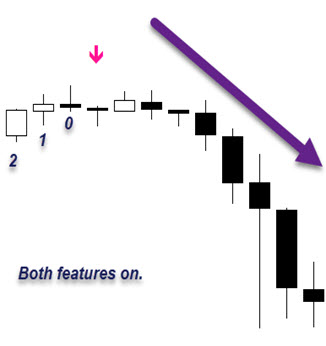

- PinBar Body Decrease? (Y/N): Bodies of last three candles including Pinbar should be Decreasing.

- PinBar Wick Increase? (Y/N): Lower shadows of the last three candles should be increasing and upper shadows for the bearish pattern.

Now, I usually use them both together. they are reliable markers to gauge the loss of momentum in a trend and subsequent reversal. But be aware, the more filters you have turned on, the less frequent the patterns happen.

- Alert On Reversal PinBar Pattern? (Y/N): Individual pattern alert should be On, Otherwise, they will appear on the chart but not throw an alert.

INSIDE PINBAR PATTERN OPTIONS----------

- PinBar + Inside On? (Y/N):

- Inside + PinBar On? (Y/N): There are two patterns here in this combo, Pics and strategy posted above.

- Alert On Pattern Detect? (Y/N): Self-explanatory!

- Alert On Breakout? (Y/N): Alert on Breakout beyond Hi/Lo of Mother bar in the direction of the pattern.

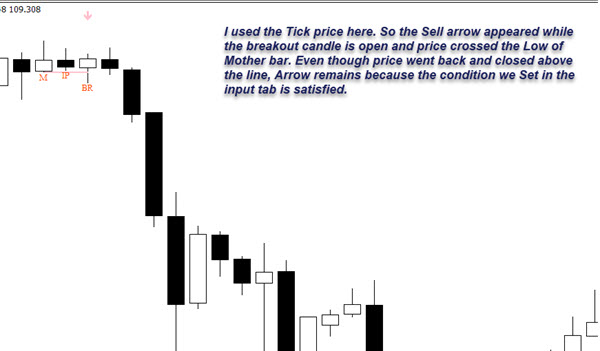

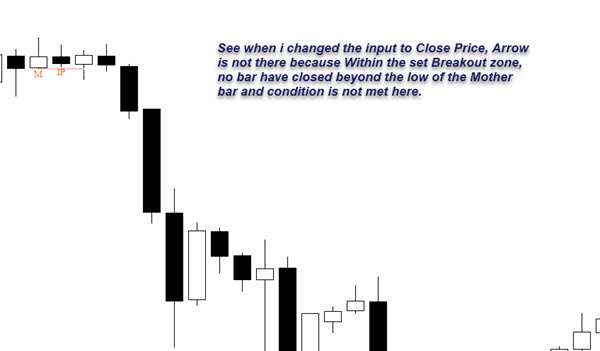

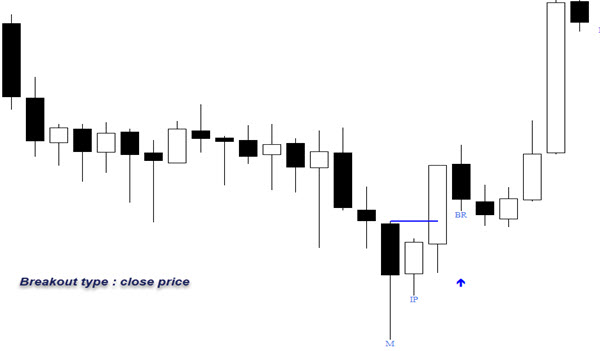

- Breakout Type: Tick price (Arrow on same candle of breakout) Or Closing Price (Arrow on Next candle after Breakout has closed beyond Hi/Lo).

Now I have selected the Close price.

- Upper/Lower Lines On? (Y/N): Line extending from High and Low of Mother bar until the end of breakout zone or until the Hi/Lo is broken, whichever comes first.

- Breakout Max Bars: 1-3, Beyond the inside bar, how many bars user is willing to wait for the breakout.

- Reverse Breakout On? (Y/N): Alert on Breakout in either direction

OUTSIDE PINBAR PATTERN OPTIONS-----------

- PinBar + Outside On? (Y/N):

- Outside PinBar On? (Y/N):

- Alert On Pattern Detect? (Y/N):

- Alert On Breakout? (Y/N): Breakout In the direction

- Breakout Type: Tick price Or Closing Price. Breakout happens in the candle next to the pattern. There is no breakout zone here.

- Proximity Zone Bars: Maximum allowed distance between Pinbar and Outside bar. This does not apply to Outside pinbar because it is a one bar pattern. The feature is explained with pictures in Dual pinbar section.

- Reverse Breakout On? (Y/N):

Arrows are coded to appear on the Current candle.

DUAL PINBAR PATTERN OPTIONS-------------

- Dual PinBar On? (Y/N):

- Alert On Pattern Detect? (Y/N):

- Alert On Breakout? (Y/N):

- Breakout Type: Tick price Or Closing Price. Breakout happens in the candle next to the pattern. There is no breakout zone here.

- Proximity Zone Bars: MAXIMUM ALLOWED distance between first and second pinbar.

TEXTBOOK PINBAR PATTERN OPTIONS---------

- Textbook PinBar On? (Y/N):

- PinBar Pattern Type: 3 Choices - draws an arrow on a.Pinbar completion, b.Confirmation while the candle is open and crossed High or Low of Pinbar, c.Confirmation candle closing beyond Hi/Lo.

- Alert On Textbook PinBar Pattern? (Y/N):

- Color Candles Textbook PinBar Pattern? (Y/N): Merely therefor aesthetic purpose. It does interfere with the signal, so trader can choose to turn it off.

LABEL SETTINGS-------------

- Show Patterns:

- Patterns Text Font Name:

- Patterns Text Font Size:

- Bullish Patterns Color:

- Bearish Patterns Color:

Comments